At this point, no one should doubt that the General Directorate of Traffic requires us to have our cars insured. And not only that, our car must be insured regardless of whether it is in motion or parked on public roads. Which brings us to one of the fines, of a not insignificant amount, that our car could receive even parked on public roads. However, Can an oversight by the DGT and our insurer cost us a €1,500 fine and the immobilization of our car?

The computerization of public administration has led to speeding up many procedures. In order for the Traffic agents to verify that our car is insured, it is no longer necessary to carry the insurance policy, nor the receipt that shows that it is up to date with the payments. A query to the DGT database is enough for an agent to check the irregular situation of our vehicle, if it has insurance, or if it has complied with the Technical Inspection of Vehicles.

But what happens when these records fail? How can I check that the DGT knows that my car is insured? What happens if an error occurs? How can I solve it?

In the process of notifying our car insurance to the DGT, errors can occur and cost us fines of up to €1,500, and even the immobilization of our car.

The insurance notification process to the DGT

When taking out an insurance policy, our insurer will inform the DGT that our car has insurance and will be registered in the Computer File of Insured Vehicles (FIVA). When purchasing a new or second-hand car, it is important that we make sure that our vehicle is insured before handing over the keys. Insurers usually complete this process from one day to the next so that, even in a second-hand car purchase that closes quickly, we can have the insurance at the time of receiving our car.

But it is important that we know that the registration in the Insured Vehicles Computer File may take some time. And that would lead us to the problem that we transfer in this same article.

There are also errors in the insurance notification that, again, lead us to the problem that we mentioned in this article. Sometimes, the insurer may not have registered our car correctly or there may even have been an error in the transfer of data, such as entering the license plate incorrectly. From my own experience, these types of errors occur relatively frequently and that is why We recommend making sure that our vehicle appears in the Computer File of Insured Vehicles and therefore that the DGT knows that our car has insurance.

The insurer is responsible for notifying the DGT that our car has insurance and registering it in the Computer File of Insured Vehicles (FIVA)

How do I check that the DGT knows that I am insured?

- If the car whose insurance we want to check is registered in our name, we can verify that you are insured by accessing the Electronic Headquarters of the DGT. From the Electronic Headquarters of the DGT We will check our points, we will find the documentation of our car and we will receive an alert if the Traffic records do not show that our car is insured.

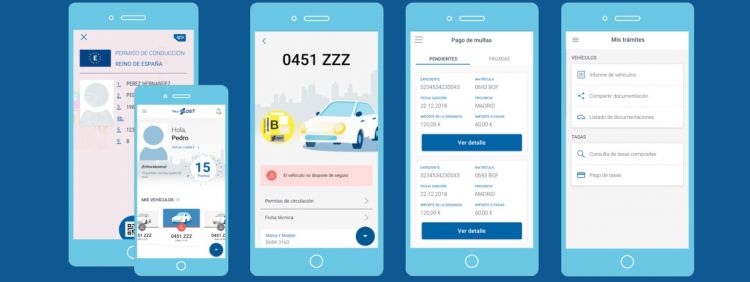

- The miDGT mobile application It will also show us this information, as in the previous case, if the car we want to check is registered in our name. We recommend downloading and using this application, in which we can take our driver’s license, check our points on the license, the circulation permit for our car and its technical file. Download miDGT app at google play (Android devices) and on the AppleStore (iOS devices).

- Requesting a reduced report from the DGT, which is free, and which can be requested regardless of whether or not a car is registered in our name, we can also check incidents, such as the vehicle’s insurance not being registered or not having a valid ITV. The electronic headquarters of the DGT allows us to quickly request these reports.

What happens if the DGT identifies our car as uninsured?

As we were saying, the problem that a car is not correctly registered in the Insured Vehicles Computer File lies in the fact that in any traffic control the agents can sanction us with a fine, and even immobilize our car.

If the verification is carried out on our parked car, the fine amounts to €800. And not only that, the Traffic agents could request a tow truck to take our car to the vehicle depot and ensure its immobilization. Traffic could claim the expenses derived from the immobilization, which would be added to the relevant fine.

If the verification is carried out in a road control, with our vehicle in circulation, the fine amounts to €1,500. Once again, the Traffic agents could request the immobilization of the vehicle and, if it cannot be done safely at the point where it was checked, request a tow truck to send our car to the vehicle depot. Once again, Traffic could claim the costs derived from the transfer by crane and immobilization.

We can be fined for not having insurance if our car is not registered correctly and is thus identified by agents in a random roadside check (€1,500 fine) or even if our car is parked (€800 fine) and our car can be be immobilized and transferred by crane to the vehicle depot

What do I do if the DGT has fined me by mistake?

If we have received a fine, because our car was not properly registered in the Insured Vehicles Computer File, The first thing we should do is contact our insurance company to inform them of the situation.request that they register our car in the FIVA and that they take charge of making the pertinent claims.

Otherwise, and after having correctly registered the vehicle as insured, we will have to start an uncomfortable process to request the DGT to cancel the fine and avoid claiming the costs derived from the immobilization if our car has been transferred to the deposit vehicular.

Contact your insurance if you have received a fine, so that they can take care of carrying out the pertinent claims, and also if you verify that your car is not correctly registered in the FIVA, so that they can resolve the situation

What do I do if my car is not registered as insured?

If we verify that our car appears as uninsured in the DGT records, we should resolve the situation as soon as possible. to avoid these kinds of problems. As we tell you in this article, it is normal for a car to be correctly registered in Traffic at the time of being insured, but unfortunately it is relatively common that some procedures are not carried out correctly.

If we find ourselves in this situation, The first thing we should do is contact our insurance, warn them of the situation and request that they re-register in the Insured Vehicles Computer File. It is important to remember, once again, that the registration may take a few days and it normally takes two or three days to see how our insured vehicle appears in the verification channels that we have detailed previously (electronic headquarters of the DGT, application miDGT and DGT report). From our experience, by contacting the insurer the situation should be resolved in a few days and the only action on their part would be to re-register our car in the Insured Vehicles Computer File.

It is also important to remember that the fact that a vehicle does not appear in the Insured Vehicles Computer File does not invalidate the insurance policy. If we suffer an accident or have to give a part or request roadside assistance, our insurance will have to comply with the conditions of the policy, as long as it is valid and we are up to date with payments, even if an error has been made when registering our car at FIVA.